Customs taxes affect how much PCBA manufacturing costs, where PCBA meaning refers to printed circuit board assembly. These taxes make materials like aluminum and steel more expensive. For example, the U.S. raised its aluminum and steel tax to 25% in March 2025. Costs are also higher when importing from China, with a 25% tax that has been active, and increases reaching 125% by April 10, 2025. Understanding what PCBA means and how taxes affect it helps you manage costs and plan for 2025.

Key Takeaways

Import taxes make materials for PCBA more expensive, raising costs.

Making products locally avoids import taxes, cuts shipping costs, and helps supply chains.

Using many suppliers lowers risks from taxes and political changes.

Free trade zones save money by storing or re-exporting goods tax-free.

Using machines and smart tech improves production and lowers future costs.

Current Customs Duties and Their Impact on PCBA Costs

What Does PCBA Mean and Why It Matters?

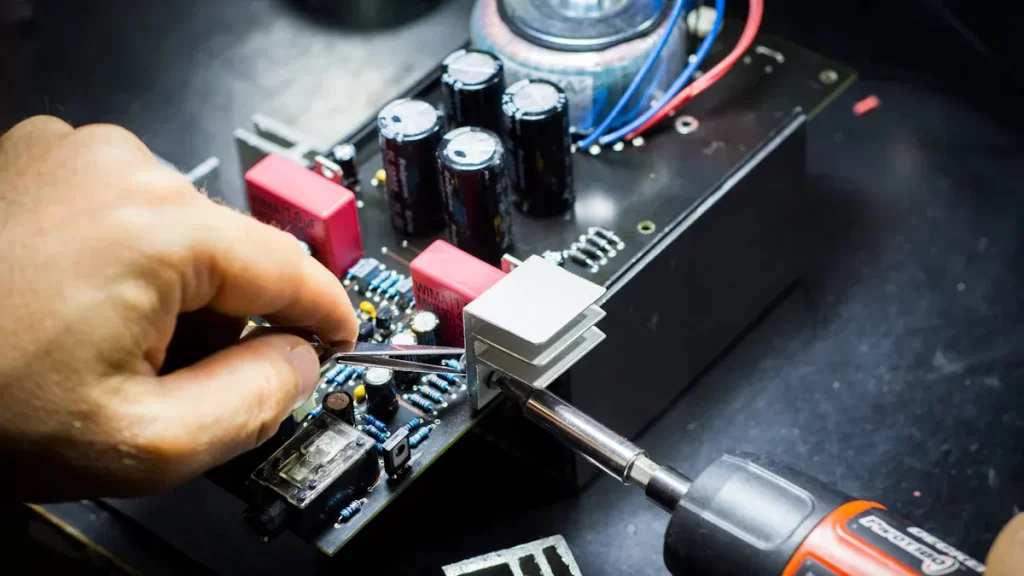

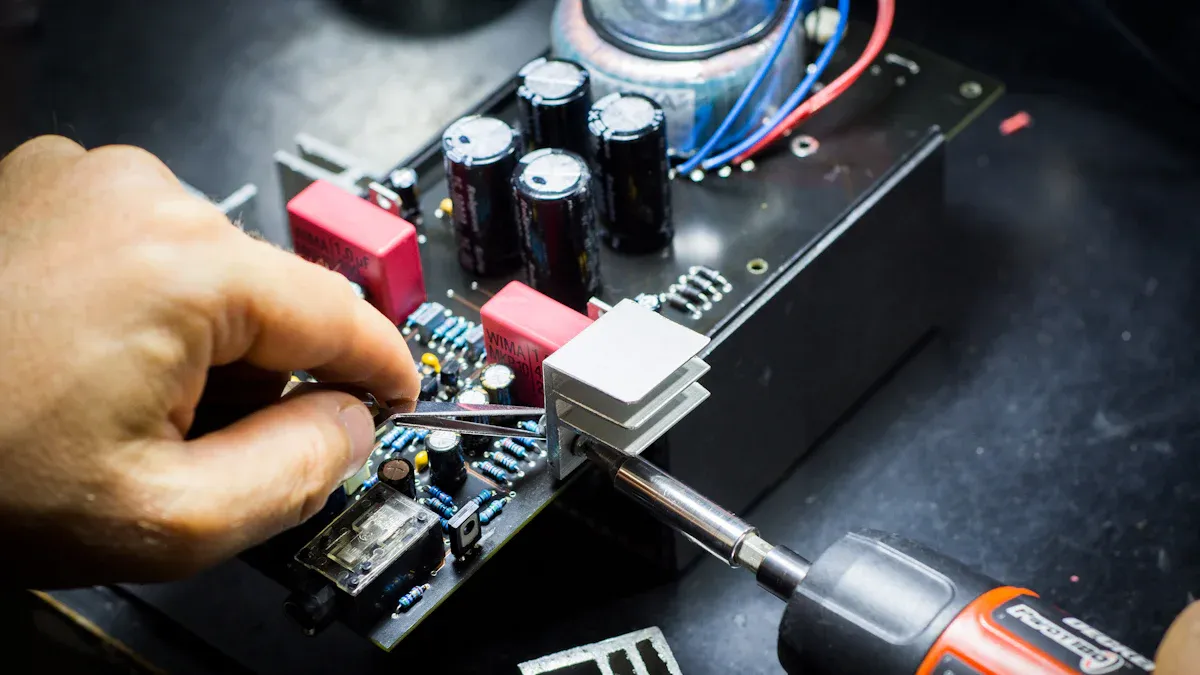

Knowing what PCBA means is very important. PCBA stands for printed circuit board assembly. It is the process of putting electronic parts on a circuit board. This process is key for making things like phones, computers, and other gadgets. Customs taxes change the cost of bringing in materials for PCBA, like semiconductors and aluminum. For example, lowering the basic customs duty (BCD) on phones, PCBA, and chargers to 15% has helped manufacturers save money. But taxes on other materials still make things harder for the industry.

Customs Duty Rates in Different Countries

Customs taxes are different in every country. Groups like the World Bank and WTO share data about these taxes. This helps companies understand global trade better. For example:

The European Union uses the TARIC system to track its taxes and rules.

The WTO website shows tax and trade info for over 150 countries.

In the U.S., new taxes on PCBs have raised costs for electronics makers.

These taxes affect where companies get their materials and how they plan their supply chains. Even with these problems, the global PCB market might grow by 5.5% in 2025. This growth is due to better technology and improved shipping methods.

How Customs Duties on PCBAs Have Changed Over Time

Customs taxes on PCBAs have gone up and down over time. These changes happen because of new trade rules. Taxes are often used to protect local businesses, but they also make imported goods cost more. For instance, the U.S. added a 25% tax on Chinese imports, including PCBs. This made production more expensive. These changes show why it’s important to follow trade rules closely. Companies also need to think about how world politics and trade deals affect these taxes.

Cost Effects of Customs Duties on PCBA Manufacturing

Higher Material Costs from Import Taxes

Taxes on imports raise the cost of PCBA materials. As gadgets get smarter, makers need materials like copper and aluminum. These materials are already pricey because many people want them. Import taxes make them even more expensive. For example:

Government rules often increase costs in the PCB and PCBA market.

Higher import taxes mean manufacturers pay more, raising supply chain costs.

Companies using foreign parts feel the most impact from tax changes.

These taxes make material costs go up a lot. This price jump makes it harder to plan budgets. In the end, it also makes PCBA products cost more for buyers.

Effects on Supply Chain and Shipping Costs

Import taxes also raise supply chain and shipping costs. When taxes go up, moving goods across borders costs more. This can mess up supply chains and cause delays. Recent studies show these effects:

Evidence | Result |

|---|---|

Taxes on key items raise costs for makers | Higher costs mean pricier products and more inflation |

Less money to spend due to taxes | People buy fewer nonessential things |

Making goods abroad can save money | Lower costs abroad may help reduce tax effects |

These problems push companies to change their shipping plans. Some look at making goods locally or buying from tax-free places. While these ideas save money, they need time and money to work.

Impact on Prices for Telecom and Electronics Products

Import taxes directly affect prices in telecom and electronics. Higher taxes make production costlier, and companies pass this cost to buyers. This is clear in telecom network costs. For example:

Import Tax | Effect on Network Costs |

|---|---|

15% | Big cost rise, especially for Vodafone Idea |

Past data shows how tax changes shaped industries:

Year | Import Tax Rate | Industry Effect |

|---|---|---|

2005 | Cut to 0% | Cheaper imports boosted competition |

When taxes rise, companies like Vodafone Idea pay more to grow networks. This raises service prices and slows tech progress. Taxes affect everything from making products to their final price.

Local Manufacturing as a Solution to Customs Duty Challenges

Benefits of Localized PCBA Production

Making PCBAs locally has many benefits. You can skip high import taxes, which lowers material costs a lot. Local production also makes supply chains shorter. This helps with easier shipping and saves money. Faster deliveries mean you can meet customer needs quickly.

Producing locally gives you better control over quality. You can check the assembly process to ensure products meet standards. It also helps the local economy by creating jobs and boosting new ideas. Governments often give tax breaks or money support to encourage local production, cutting costs even more.

Challenges in Scaling Local Manufacturing

Growing local production has challenges. Timing is very important. Expanding too soon can hurt your budget, but waiting too long may lose chances in the market. Guessing demand correctly is also hard. If you make too much, you waste resources. If you make too little, customers may be unhappy.

As sales grow, limits in production can appear. If you don’t check your production often, slowdowns can happen. Finding skilled workers is another issue. Without trained workers, work slows down, and labor costs go up.

To succeed, watch your production closely. Check profits and costs to stay financially strong. Using technology wisely can make work faster and help you grow better.

Balancing Cost, Quality, and Scalability in Local Production

Balancing cost, quality, and growth needs smart choices. Picking common parts and finding other options can save money. Testing small batches before making more helps find the right amount to save costs.

Mixing machines and hand assembly can save money. Machines are good for big tasks, while hand assembly works for tricky ones. Testing designs early can cut costs and keep quality high.

Using advanced tools like 3D inspections improves quality and saves money over time. By focusing on these steps, you can grow local PCBA production in a smart and steady way.

Government Policies and Global Trade Dynamics in 2025

Expected Changes in Trade Agreements

Trade rules in 2025 may change a lot. These changes will affect how PCBAs are made. Governments want to lower taxes and depend less on one region. This helps fix weak spots in supply chains for important electronics. Many countries now want to make key parts at home.

Safety concerns are also shaping trade rules. Countries use these rules to get deals in other areas. The COVID-19 pandemic showed why strong supply chains matter. Because of this, countries are trying to use more suppliers. These changes may change how you buy materials and make products.

Effects of Political Issues on Customs Taxes

Politics still affects customs taxes in big ways. Changes in rich countries can mess up supply chains. This makes it harder to guess costs. For example, the U.S. needs to import semiconductors because it doesn’t make enough. But new taxes from the next government could raise costs for PCBA makers.

The CHIPS Act gives over $33 billion to help make semiconductors in the U.S. This plan could create 128,000 jobs but may not meet all needs. So, you might still struggle to find cheap parts.

How Growing Markets Affect PCBA Trade Rules

Newer markets are shaping PCBA trade rules more now. These places are cheaper for making things, so companies like them. You could save money by buying parts or making products there.

Governments in these areas are making rules to bring in foreign businesses. They offer tax cuts, lower tariffs, and better roads and factories. By working with these markets, you can avoid problems from politics and high taxes.

Strategies for Stakeholders to Handle Customs Duty Issues

Expanding Supply Chains to Lower Risks

Depending on one supplier or area can be risky. Customs taxes, political changes, or disasters can stop your work. Expanding your supply chain helps avoid these problems and keeps things steady.

Here’s how to expand your supply chain:

Get materials from different places: Find suppliers in various countries. This lowers the effect of high taxes in one area.

Use local suppliers: Working with nearby vendors cuts transport costs and skips import taxes.

Have backup suppliers: Always keep extra suppliers ready. This helps you switch quickly if needed.

Tip: Use software to check and manage suppliers. It helps find good partners and track costs.

Expanding your supply chain reduces risks and adds flexibility. It helps you adjust to new trade rules and market changes.

Using Free Trade Zones and Agreements

Free trade zones (FTZs) and trade deals can save you money. They help lower or skip customs taxes, making your business cheaper to run.

Why Free Trade Zones Help:

Goods in FTZs don’t pay taxes until they leave the zone.

You can re-export items without paying taxes, saving on unused stock.

FTZs often clear customs faster, avoiding delays.

Important Trade Deals to Know:

USMCA: This deal cuts taxes between the U.S., Canada, and Mexico.

ASEAN Free Trade Area: It lowers taxes on many goods in Southeast Asia.

European Union Trade Deals: The EU has agreements with many countries to reduce taxes.

Note: Check each deal’s rules carefully. Some need a certain amount of materials from member countries to get tax cuts.

Using these tools saves money and helps you compete better worldwide.

Adding Automation and Smart Technologies

Automation and new tech can help with customs tax costs. They make work faster and cheaper, keeping you competitive.

Why Automation Works:

Cuts labor costs: Machines do simple tasks faster and better than people.

Improves quality: Automated tools keep production steady and reduce waste.

Speeds up work: Faster systems help meet customer needs quickly.

Examples of Smart Tech:

Robotic assembly lines: These make PCBA work faster and with fewer mistakes.

AI tools for supply chains: AI predicts demand and manages stock, cutting extra inventory.

Energy-saving machines: New machines use less power, lowering energy bills.

Insight: Automation costs a lot at first, but it saves more money over time.

Using these technologies cuts costs and prepares your business for growth. It keeps you ahead in a fast-moving industry.

Customs duties will keep affecting PCBA costs in 2025. These taxes can mess up supply chains and raise production costs. To handle these issues, try local manufacturing, use different suppliers, and take advantage of trade deals.

Tip: Work with policymakers to learn about trade updates.

Using smart tools like automation can also lower costs. By planning ahead, you can adjust to changing trade rules and stay competitive in the market.

FAQ

What do customs duties do in PCBA manufacturing?

Customs duties make importing materials like semiconductors cost more. These taxes raise production costs and product prices. Knowing about these duties helps you plan and save money.

How does local manufacturing lower customs duty costs?

Making PCBAs locally avoids import taxes on materials. It also cuts shipping costs by shortening supply chains. Governments often give tax breaks for local production, saving even more money.

Are free trade zones helpful for PCBA companies?

Yes, free trade zones (FTZs) let you store or re-export goods without paying taxes. This lowers costs and speeds up customs processes. FTZs are great for businesses with global suppliers.

How do global politics affect customs duties?

Political problems can cause higher taxes or trade limits. These changes mess up supply chains and raise costs. Keeping up with world news helps you prepare for these issues.

What tools can cut PCBA costs?

Automation and AI make production and supply chains faster. Robotic tools work efficiently, and AI helps manage stock and demand. These tools lower labor costs and reduce waste, saving money over time.

Tip: Begin with small automation steps to control starting costs.

See Also

Exploring Turnkey And Consignment PCBA Manufacturing Options 2025

Top One-stop PCBA Manufacturing Services Compared for 2025

Navigating ITAR Regulations For PCBA Manufacturing In 2025

The Importance Of Automotive PCBA Assembly In 2025

Essential Technologies Shaping PCBA Manufacturing For Electronics Today