Changes in customs duty affect mobile PCBA costs. For instance, lowering the duty on parts from 20% to 15% helps local production grow. Companies save money and can sell more overseas. Buyers might pay less, showing how these changes impact the supply chain.

Key Takeaways

Changes in customs duties affect mobile PCBA prices. Lower duties mean cheaper production, which lowers prices for customers.

Companies can save by getting materials nearby or using trade deals. This keeps them competitive and helps control growing expenses.

Knowing trade rules is very important for companies. Learning about customs duties helps businesses adjust and succeed in a changing market.

Understanding Mobile PCBA and Its Global Role

What Is Mobile PCBA?

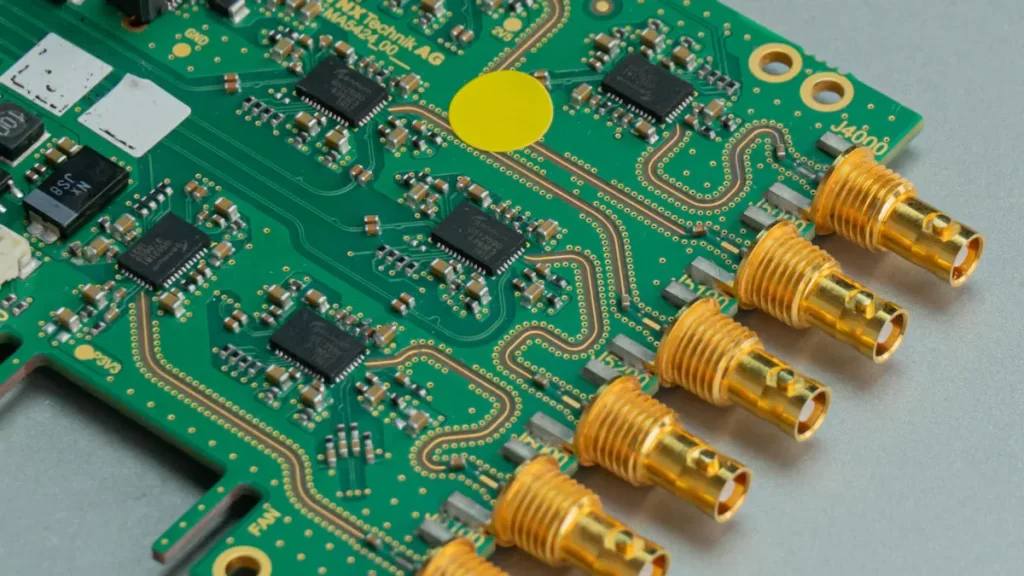

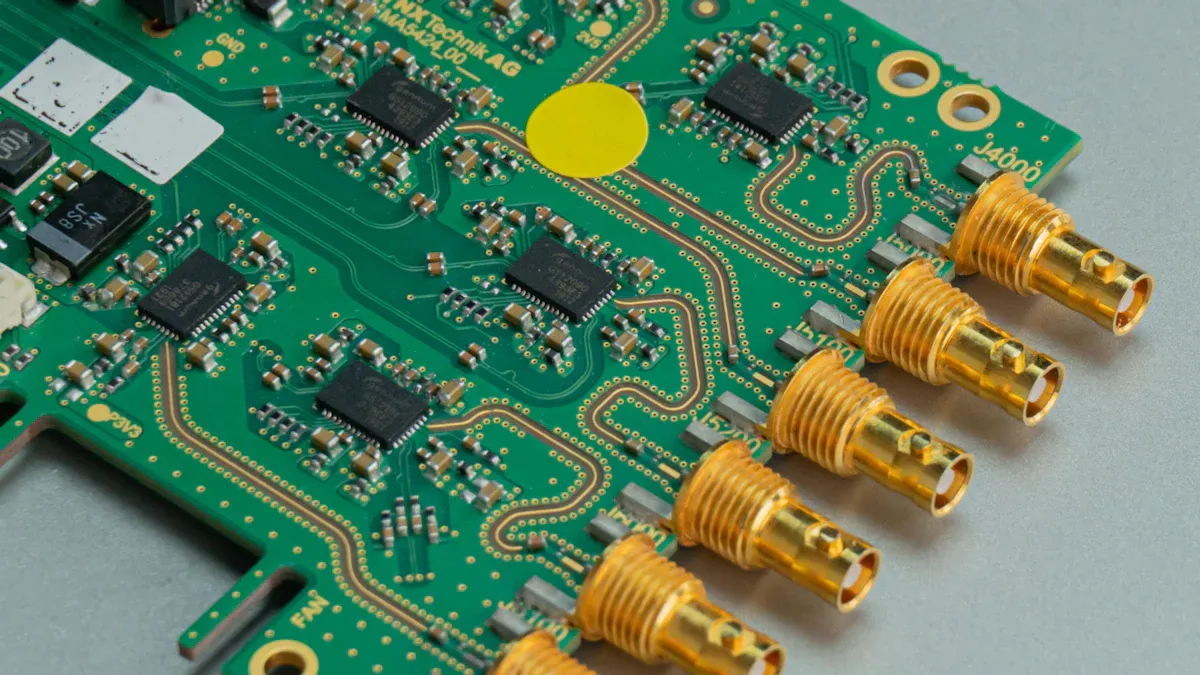

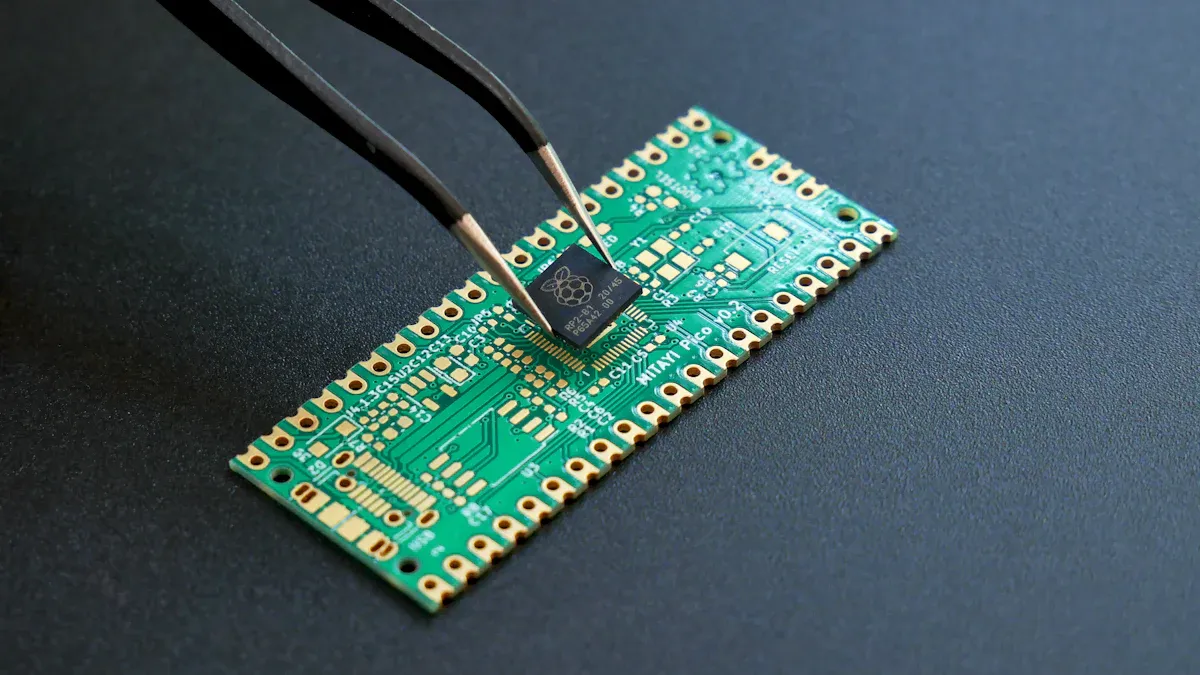

Mobile PCBA means putting electronic parts onto a circuit board. This board connects the parts so they work together smoothly. Without PCBA, mobile devices would not work. For example, a smartphone’s PCB becomes a motherboard PCBA when parts like chips are added. This lets the phone turn on and work properly.

PCBA is very important for mobile phones. It links and controls key parts. It also protects the phone from heat, shocks, and other daily issues. PCBA makes sure your phone works well and has great features. In short, it is the heart of modern smartphones.

Key Components and Global Supply Chain Dependencies

Mobile PCBA needs important parts like chips, sensors, and capacitors. These parts come from many countries, so global trade is crucial. For example, a phone’s chip might be designed in the U.S., made in Taiwan, and put together in China. This shows how countries work together to make phones.

But problems in the supply chain can cause big issues. For instance, a chip shortage cut EU car production by 23% in 2021 compared to 2019. Other industries like tech and electronics were also affected. When big economies struggle, the whole supply chain suffers. This shows why strong trade rules and varied suppliers are important.

Customs Duty on Imports and Its Impact on Costs

How Customs Duty Works

Customs duty is a tax on goods entering a country. When items are imported, a tax is paid based on their type and value. For example, bringing electronic parts into India means paying a percentage of their cost as customs duty. This tax makes imported goods costlier than local ones, helping local businesses.

Governments use these taxes to control trade and earn money. Goods are grouped into categories, each with its own tax rate. For instance, mobile PCBA parts may have lower taxes than luxury goods. Sometimes, governments change these rates to manage imports. This process ensures trade policies help the economy.

Effects of Duty Changes on Mobile PCBA Costs

Changes in customs duty affect mobile PCBA production costs. If the government raises taxes on imports, raw materials cost more. This increases production costs and may lead to higher prices for buyers. Lowering taxes, however, reduces costs and makes products cheaper.

For example, India lowered taxes on some parts to boost local production. This made it cheaper to produce electronics in India. At the same time, higher taxes on finished goods like phones protect local industries. These changes affect the entire supply chain, impacting businesses and buyers.

Duty changes also affect global trade. If one country raises taxes, others might do the same. This can slow down trade and raise costs for industries using global supply chains. For mobile PCBA, which relies on imports, such changes can delay production and raise prices.

Examples of Recent Duty Adjustments

India has recently changed its customs duty rules. In 2023, it lowered taxes on some electronic parts to grow local production. This aimed to make India a leader in electronics manufacturing. At the same time, taxes on finished goods like smartphones were raised to promote local assembly.

Another change was adding GST to imports. This tax applies to goods entering the country, increasing their cost. For example, importing PCBA parts means paying both customs duty and GST. Together, these taxes raise the final price of products.

Globally, countries like the U.S. and China have also changed customs rules. Trade issues between them led to higher taxes on many goods, including electronics. These changes show why it’s important to understand customs duty and its effects on industries like mobile PCBA.

Addressing the Impact of Customs Duty Changes

Strategies for Manufacturers

Manufacturers can use smart strategies to handle rising costs from customs duties. One way is to improve supply chains and depend less on costly imports. For example, buying materials locally or from countries with good trade deals can save money. Free Trade Agreements (FTAs) help cut tariffs, saving companies millions each year.

Here’s a simple look at successful strategies manufacturers use:

Strategy | Duty Savings (Annual) | Notes |

|---|---|---|

Initial duty savings identified | US$10 million | Changed supply chain to save money |

Additional FTA opportunities | US$1.2 million | Saved more with Free Trade Agreements |

Reduction in duty exposure | US$2.7 million to US$467,000 | Lowered overall taxes and duties |

These ideas show why planning ahead is important. Finding ways to lower customs duties helps protect profits and stay competitive. Adjusting tariff rates also supports steady growth for local manufacturing.

Using technology is another helpful method. Automation and data tools can track duty changes and adjust buying plans. This keeps costs low and production running smoothly.

Role of Governments and Trade Policies

Governments make trade rules that affect customs duty rates. In India, duties on imported ICT goods range from 2.5% to 20%. These rates protect local businesses but make imports more expensive. This can hurt foreign companies and limit their market access.

Trade talks often lower tariffs, helping industries like mobile PCBA. Deals like GATT/WTO reduce tariffs slowly, while U.S. FTAs remove them in 5–10 years. This makes global trade easier for businesses.

Governments also use rules to balance growth and industry protection. For example:

India adds GST to imports, making them costlier. This double tax system—customs duty plus GST—pushes businesses to buy locally.

More exports from trade deals grow the economy and create jobs, boosting production and sales.

Trade rules aim to lower tariffs on less-sensitive imports. This protects local industries while encouraging global trade. These changes can lead to better efficiency and higher profits for companies.

Manufacturers should learn about these policies to handle duty changes well. Working with policymakers and supporting fair tariff rates can help businesses adjust to new trade rules.

Changes in customs duty affect the mobile PCBA industry widely. They can raise costs for companies and increase prices for buyers. In India, changing duties supports local production and industries. Planning smartly, like making products locally, helps handle these changes better.

FAQ

Why does customs duty affect mobile PCBA costs?

Customs duty makes imported parts more expensive. This increases production costs for companies and raises prices for buyers.

How can manufacturers handle customs duty changes?

Tip:

Buy materials locally or use Free Trade Agreements. Improve supply chains to depend less on costly imports.

Why do governments change customs duty rates?

Governments change rates to help local businesses and boost production. These changes also aim to fix trade gaps and grow the economy.

See Also

Exploring Turnkey And Consignment PCBA Manufacturing Options 2025

Outsourcing Medical Device PCBA Manufacturing: Key Advantages And Disadvantages

Boosting PCBA Production Speed While Maintaining High Quality

Navigating ITAR Regulations For PCBA Manufacturing In 2025

Evaluating Top Comprehensive PCBA Manufacturing Services For 2025