The year 2025 brings big changes in global trade rules, especially for PCBA industries. There are important updates in PCBA HS codes and taxes on electronics and semiconductor imports. For example, the U.S. will add taxes up to 50% on some semiconductor products. This will affect how supply chains work. Also, the global PCB market is expected to grow by 5.5%, pushed by new taxes and changing rules. These changes mean businesses must focus on following rules and managing costs as trade policies quickly change.

Key Takeaways

In 2025, the U.S. raised taxes on chips and metals. This made PCBA production more expensive. Companies need to plan their budgets.

New HS codes for advanced PCBA tech make sorting products easier. Using the right codes avoids fines and shipping delays.

Different tariffs in regions can change costs a lot. Buying materials from places like Mexico can save money.

New taxes and HS code changes might cause supply problems. Check your plans often to avoid delays and extra expenses.

Trade experts and digital tools make following new rules easier. They help with correct paperwork and fewer mistakes.

Recent Tariff Changes in PCBA Trade

Key updates in U.S. tariffs, including Section 232 changes

In 2025, the U.S. made big changes to tariffs under Section 232. These updates aim to help local industries but create problems for businesses importing steel, aluminum, and electronics. The new rules include higher tariffs and fewer exemptions for some countries. For example:

Product Type | Tariff Rate | Effective Date | Exemptions/Notes |

|---|---|---|---|

Steel | 25% | March 12, 2025 | No more country exemptions; new products now taxed |

Aluminum | 25% | March 12, 2025 | Many exemptions ended; Russian products taxed at 200% |

These higher tariffs raise costs for materials used in PCBA production. If your supply chain depends on imported steel or aluminum, you might see higher expenses. The harmonized tariff schedule (HTS) now has stricter rules, so following them is more important than ever.

Note: Past data shows Section 232 and Section 301 tariffs shaped today’s trade rules. These policies still affect electronics, with changing rates and fewer exemptions impacting businesses.

Effects of higher tariffs on steel, aluminum, and electronics

The new tariffs have big effects on the PCBA industry. Higher steel and aluminum tariffs increase production costs. Electronics also face extra taxes. These changes cause inflation and economic pressure. Look at this data:

Metric | Value |

|---|---|

Projected GDP Reduction | 0.8% |

Average GDP Loss | USD 29 billion per year |

Average Job Losses | 26,000 jobs per year |

Average Tariff Rate on Fabricated Metals | Above 30% |

Average Tariff Rate on Electrical Equipment | 10% – 15% |

Inflation could rise to 4.5% because of these tariffs. For businesses, this means higher costs and possible supply chain issues. The harmonized tariff schedule now has tougher rules, so reviewing your compliance plans is key.

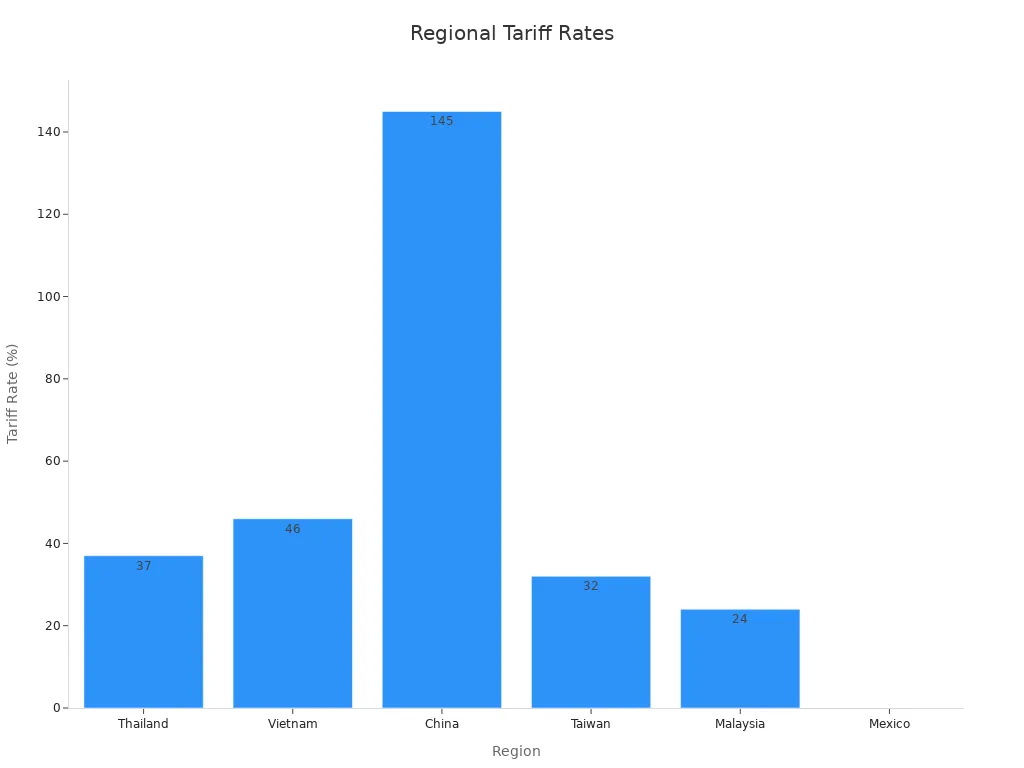

Regional tariff changes and their effects on PCBA

Regional tariff changes also shape the PCBA trade world. Countries like China, Vietnam, and Thailand now have higher tariffs. Mexico, however, offers zero tariffs if certain rules are followed. Here’s a summary:

Region | Tariff Rate (%) |

|---|---|

Thailand | 37 |

Vietnam | 46 |

China | 145 |

Taiwan | 32 |

Malaysia | 24 |

Mexico | 0 (if conditions met) |

China faces a 145% total tariff rate, including extra taxes. This makes it harder for businesses buying PCBA parts from China. You may need to find new suppliers or renegotiate deals to handle these tariffs.

Tip: Keep track of regional tariff rules to save money. Mexico might offer better trade deals if you meet their conditions.

Updates to PCBA HS Code Classifications

New HS codes for advanced PCBA technologies

In 2025, new HS codes were added for advanced PCBA types. These codes help classify flexible PCBs, multi-layer boards, and AI-integrated PCBs. Flexible PCBs now have their own HS code, making tracking easier. This change helps businesses correctly classify new products. It also lowers the chance of penalties for wrong classifications.

Check these updates if you work with advanced PCBA technologies. Knowing the rules helps you follow trade laws and avoid customs delays.

Changes to existing PCBA-related codes

Existing PCBA HS codes were reclassified into more specific groups. For example, single-layer and double-layer PCBs now have separate codes. This change improves trade reporting accuracy but adds work for businesses. You must update your documents to match these new rules.

If you don’t adjust, you might face higher tariffs or shipment issues. To prevent problems, review your HS codes and ask experts for help if needed.

Regional differences in HS code rules for 2025

HS code rules differ by region in 2025. The national average tariff rate is 12.4%. Some areas, like the Mountain West and Southeast, have lower rates of 2% to 7%. But the industrial Midwest faces higher rates, often over 10%. These differences depend on local industries and global supply chain use.

If your business is in a high-tariff area, costs may rise. To save money, buy materials from low-tariff regions or renegotiate contracts. Knowing these regional differences can help you cut costs and improve your supply chain.

Impact on Supply Chains and Business Operations

Cost implications of tariff increases and HS code changes

Tariff hikes and new HS codes in 2025 raise costs. Buying raw materials, parts, or goods now costs more. For example, tariffs on Chinese imports are now 20%. Mexico and Canada face even higher tariffs at 25%. These changes increase expenses if your supply chain depends on these areas.

Knowing the HS code for each product is very important. Wrong codes can cause fines or shipping delays. For instance, new codes for advanced PCBA need updated paperwork. Keeping up with these changes helps avoid problems and extra costs.

To lower costs, try using suppliers from low-tariff regions. This can help you save money and stay competitive. For example, switching from Southeast Asia to Mexico could cut solar panel costs. Solar panel tariffs rose by 7%, while wind turbine blades from Mexico now cost 6% more. Planning ahead is key to handling these trade changes.

Supply chain disruptions due to reclassification and compliance challenges

New HS codes and stricter rules have caused supply chain issues. Customs delays happen if your documents don’t match the new codes. For example, single-layer and double-layer PCBs now have separate codes. This makes trade paperwork harder and needs more effort to follow rules.

These issues can cause stock shortages or longer wait times. If you use just-in-time inventory, small delays can cause big problems. For instance, battery storage costs went up due to higher tariffs on Chinese batteries. Batteries are vital for renewable energy projects. These problems show why strong supply chain plans are important.

Using digital tools can help solve these issues. Automated systems track HS code updates and calculate tariffs. They also create correct documents. These tools reduce mistakes and keep your supply chain running smoothly.

Strategies to mitigate risks and maintain operational efficiency

Dealing with these changes needs smart planning and new tools. Start by checking your supply chain for weak spots. Risk analysis can find problems and help fix them. For example, a petrochemical company used this method to cut risks and improve work.

Having suppliers in different regions is also helpful. This reduces reliance on high-tariff countries and ensures steady supplies. Mexico, with zero tariffs under certain rules, is a good option for PCBA parts. Exploring such choices can save money and handle global trade challenges.

Lastly, work with trade experts who know about tariffs and compliance. They can guide you through HS code changes and regional rules. Combined with digital tools, these steps help you adjust and stay efficient.

Tip: Stay updated on trade changes to avoid supply chain problems. Regularly check your compliance plans and supplier deals to stay prepared.

Adjusting to China Tariffs and Global Trade Changes

Handling higher tariffs on Chinese imports

Rising tariffs on Chinese goods are causing problems for businesses. Some tariffs now go up to 20%, making imports cost more. This has led to supply chain issues. For example:

Smartphone makers see production costs rise by 4-7%.

Gaming hardware companies face delays in product launches.

Businesses are finding new suppliers or moving factories to cheaper countries.

You should check how these changes affect your business. Planning early can help avoid extra costs and delays. Look at your supply chain to find where costs increased. Then, find ways to lower these costs and solve problems.

Finding new sourcing and manufacturing options

Global trade changes bring new chances for sourcing and making products. U.S. trade with China dropped from 21.2% in 2018 to 13.9% in 2023. Mexico is now the top U.S. trading partner, with a 15.4% share. Many companies use a “supplier + 1” plan. About 57% of manufacturers are trying this idea.

You can buy materials from places like Mexico, which has lower tariffs. This can save money and reduce risks from high tariffs. Having more suppliers ensures you get materials even during trade problems. Preparing now helps you stay ahead in the changing market.

Using trade experts and digital tools for compliance

Dealing with new tariffs and trade rules needs skill and accuracy. Trade experts and digital tools can make this easier. For example:

Service Type | What It Does |

|---|---|

Internal Audits | Checks customs entries, tariffs, and free trade agreement use. |

Post-Verification Audits | Reviews customs audits for appeals and future compliance plans. |

Free Trade Agreement Review | Finds and applies helpful trade agreements for imports. |

Supply Chain Audits | Looks at supply chain risks and gives ideas for improvement. |

These services help with correct HS code use and following trade rules. Digital tools can calculate tariffs and create proper documents. This saves time and avoids mistakes. By mixing expert help with technology, you can handle changes well and keep your business running smoothly.

The year 2025 has seen big changes in PCBA trade rules. These changes raise costs and force businesses to adjust fast. Knowing about tariff breaks and new rules can save money. Planning ahead and following rules carefully helps handle these changes well. Finding new suppliers and getting expert help can lower risks. This also helps businesses stay strong in the global market.

FAQ

What are tariff rates, and why do they matter for PCBA trade?

Tariff rates are taxes on goods brought into a country. They raise costs for materials like steel, aluminum, and electronics. Higher tariffs make production more expensive and affect product prices.

How can you ensure compliance with new HS code classifications?

Check updated HS codes often and match them to your products. Use digital tools or ask trade experts for help to avoid mistakes and fines.

What steps can you take to mitigate the impact of rising tariffs?

Find suppliers in areas with lower tariffs to save money. Renegotiate deals to cut costs and look into trade agreements for discounts or exemptions.

How do regional tariff differences affect your supply chain?

Some places, like Mexico, have no tariffs if rules are followed. Others, like China, have high tariffs. Knowing these differences helps you choose cheaper suppliers.

Why is it important to stay updated on trade policy changes?

Trade rules and tariffs change often. Staying informed helps you adjust quickly, avoid problems, and keep your business running smoothly.

See Also

Navigating ITAR Regulations for PCBA Production in 2025

Evaluating Top All-in-One PCBA Manufacturing Solutions for 2025

Turnkey PCBA Manufacturing Compared to Consignment Options in 2025

Essential Technologies Shaping PCBA Production for Today’s Electronics

New Developments in FDA-Compliant PCBA Solutions for Healthcare